Automatic Enrolment Workplace Pension

'Automatic enrolment' is a Government legislation introduced for employers to auto-enrol eligible workers into a pension scheme if they are not already contributing into a pension.

While many employers have set up and operated some form of 'Company' pensions schemes for some or all of their employees to contribute into, there were a lot of employees whose workplace do not have any schemes to enable employers to save into such schemes.

In the past, many workers missed out on valuable pension benefits, because their employer had not made setup pension schemes or the employees did not apply to join their company's pension scheme.

The Government is now making it easier for employer to setup pension schemes and for eligible/entitled employees to be automatically enrolled into such scheme.

Automatic enrolment compliance entails a lot of requirement that are handled either by a Human Resources (HR) Management System or a specialist Automatic Enrolment Compliance Software. There are many requirements under the pension 'Auto Enrolment' regulations which are complex and such functionalities are beyond the scope of payroll software. The management of Auto Enrolment criteria, communication with employees and pension providers, documentation and reporting requirement is not a standard payroll function.

Andica has always included pension processing function within the payroll software and caters for pension schemes, pension calculations and reports for pension contributions.

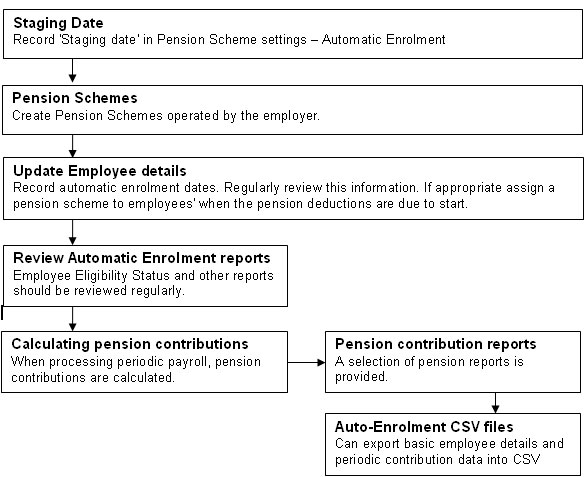

Pensions feature within Andica Payroll Software has been enhanced to provide core payroll software related functions for 'Automatic enrolment'. These include recording key dates such as 'Staging Date', routines to create pension schemes, producing various reports, e.g. employees' eligibility status and pension contributions reports, calculations of pension contributions, etc. Your pension provider may have other requirements that are outside the scope of payroll software.

The Pension Schemes feature can be used to handle most pensions schemes as per HMRC regulations, you can use this feature to setup eligible schemes that the employer wants to operate under the 'Auto enrolment' requirements. Once you have identified which employees meet the criteria for pension auto enrolment, you can assign the employees to a pension scheme that you have setup. Routine below is a typical automatic enrolment pension recording and reports printing process within the software.

Note: This is not a complete payroll processing routine or a pension provider's process. Your pension provider may require other information that are not part of a payroll software function.