Payroll Software

Andica Payroll Software is a powerful and flexible payroll solution.

Processing payroll can be one of the most time consuming tasks for any company but Andica payroll software puts you firmly in control.

The payroll solution is suitable for most types of employers, small to medium sized businesses, charity organisations and complies with the latest government legislations.

Andica Payroll Software is easy to use, it allows payments of salaries and wages and non statutory deductions to be defined by users to suit the business needs while the payroll package takes care of the statutory calculations.

The software has been accredited after going through rigorous Inland Revenue Quality Standards for payroll solutions and electronic filing of year end tax returns using File By Internet process via the Government Gateway. The Inland Revenue's Payroll Standard helps employers identify payroll programs with the essential features necessary to calculate PAYE software, National Insurance Contributions, Statutory Payments - Sick Pay, Maternity Pay, Paternity Pay, students loan deductions and perform a range of other functions.

Unlimited User Defined Payments, Deductions, Loans & Advances - Andica Payroll package allows unlimited types of payments, deductions, loans & advances and tax treatment for each item. Once set and linked to employee records, it enables easy and speedy payroll calculations.

Payroll Processing - flexible payroll processing with the option to run Weekly, Fortnightly, Four Weekly or Monthly payroll. Simply select the employees to be processed and enter details or accept the standard payments and deduction preset for each employee, Andica payroll will automatically work out tax calculations and other payments and deductions.

Calculations of statutory sick pay (SSP), statutory maternity pay (SMP), paternity pay (SPP), adoption pay (SAP), tax credits, deduction of court orders, students loan are automated.

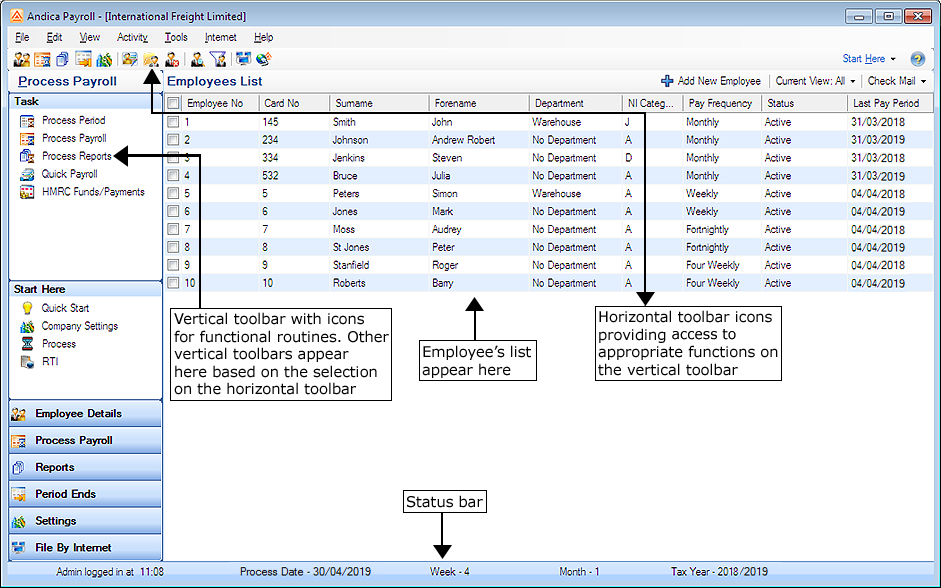

All payroll processing functions are accessed from a clearly defined toolbar or menu structure. If you make a mistake during the payroll process, then simply go back to the payroll process and enter correct details for a particular employee and the payroll values will be recalculated with a few clicks.

Easy to Use - designed with business owner managers, payroll departments and other non-IT users in mind and comes with an easy to navigate and intuitive windows interface. Employee’s details are stored on a central screen with a series of tabs making it very easy to find information. Payroll processing activities can be accessed using icons on vertical and horizontal toolbars and drop down menus allowing processes to be completed quickly and easily.

Scalable - Supports 1 to unlimited employees. The software can be purchased for a suitable number of employee bands. As your business grows you can upgrade the number of employees without the need to reinstall the software or re-key existing employee's data.

Reports - predefined built in reports grouped by activities. Reports include payslips, employee’s payroll analysis, statutory payments (SSP, SMP, SPP, SAP), period-end payroll summaries, year end summaries. Prints all of the standard Inland Revenue reports as well including P32, P45, P35 (cs), P14 and P60.

Quick Payroll Calculations - provides a feature to quickly calculate an employee’s tax.

Pension Calculations - create pension schemes linked to most standard contracted-out pension categories such as COMP, COSR, stakeholder pension. Details of pension schemes including employers and employees contributions as a percentage or fixed value can be set and the pension schemes linked to the employees allowing regular automatic calculations and deductions.

Online Filing - a File By Internet feature to enable you to securely submit returns electronically to Inland Revenue via the Government Gateway.

Security - provides extensive security features for user rights.

Multiple Company/Employers - an optional Multi Company/Employer feature that can be enabled by purchasing additional licences for each employer you set up.

Global Changes - universally amend payroll details such as tax codes, NI categories, payment and deduction setting flags, employee records and much more.

Reverse Process - used to open a 'closed period' for an employee or a range of employees and clear salaries, taxation values, etc. allowing users to reprocess payroll in the event of an error.

Import and Export - import employee records and employee's payment units and rates and export employee details to and from Comma separated value (CSV) files.

Net to Gross - enter net earning and work back the gross pay by adding back taxes.

Andica Payroll desktop

Click on image to enlarge

Latest News

This software has been checked and meets the requirements of the published HM Revenue & Customs Payroll Standard and the relevant sections of HM Revenue & Customs Quality Standard. It incorporates online filing capability by internet. Extra Pay Frequencies are not supported. Directors' National Insurance is supported. Contracted-out and Net Pension Deductions are supported.

Read More